State Bank of India (SBI) is the largest bank of India. It has its branches not only in India, but also in many parts of the world. However, there are many villages of India, where there is no branch of any bank. So, in such places, the SBI gives an individual an opportunity to open a Customer Service Point or CSP of the bank in order to serve the people of these far-flung areas.

If you are up to the mark of the eligibility criteria set by the SBI to start its Customer Service Point outlet, you can provide local consumers with the basic financial services on behalf of SBI, and at the same time earn money as well.

Eligibility Criteria for opening a SBI Customer Service Point

If you want to run a CSP, you should fulfil following eligibility criteria:-

1. You should have passed intermediate (10+2).

2. You should have basic knowledge of computer.

3. You should have adequate space for opening a CSP.

4. You should be of 21 years of age or above.

5. You should have a good local reputation with no criminal background.

You should have following documents as well:-

- Id Proof – Voter Id/ Driving License/ Passport etc.

- PAN Card

- Aadhaar Card

- Address Proof for Residential and for CSP

- Shop Agreement

- Character/ Police Verification Certificate

- Educational Certificates – class 10th onwards.

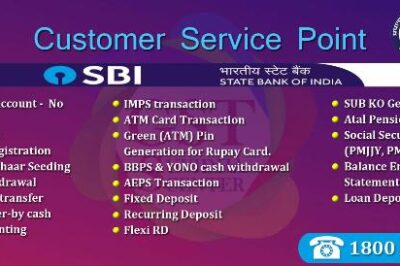

Services that your CSP can provide to the customers:-

- Opening of account

- Printing of passbook

- Deposit and withdrawal of money

- Money transfer

- Jan Dhan Account

- Atal Pension Yojna account

- PM Jeevan Jyoti Yojna

What do you require to run a CSP

There are a certain things that you would require to run a CSP:-

- Two or more laptops or computers with internet connectivity.

- They should be running Windows 7 operating system or above and should have at least 4GB RAM and 5GB Hard Disk, and 5 hours of battery backup.

- Scanner and Money counting machine.

- Two printers (Inkjet+ Dot Matrix) for printed acknowledgment of each transaction.

- Bio-metric authentication for secure transactions

How and Where, you can open a CSP?

You can open a CSP in your area first by analysing its need in your area, and then by following these steps:

Step 1: Visit the nearest SBI branch and meet the Branch Manager there. Tell the manager that you want to open a CSP in your area.

Step 2: After checking your credentials and eligibility, the branch manager will redirect you to the bank’s Regional Business Office (RBO), where your request will be processed.

Step 3: You can also directly approach the RBO of your area for a CSP. You get information about RBO by taping at https://bank.sbi/web/home/locator/branch.

Step 4: Besides RBO, the branch manager can also redirect you to a private CSP service provider to help you set up an SBI CSP in your area.

Step 5: You can also check your respective service provider online and fill up an online registration form.

Step 6: The service provider will then forward the submitted application and the required documents to SBI for verification.

Step 7: After validation, you will be notified through mail or SMS with a unique code for your SBI CSP account login.

Step 8: You will be trained before your CSP gets operational.

Note: This process takes a little time only. You also don’t have to pay anything extra except the registration charge before the allotment of CSP.

Your Earnings:-

As a owner of the CSP, you can earn good, provided you handle a good volume of financial services every month. Apart from a monthly fixed salary from the SBI, you also get good commission for services such as carrying out banking-related transactions, loan consultation and selling pension plans and insurance policies. Overall, you can earn a good amount of money, up to 40,000 INR every month.